Ireland Forecast To Record Strongest Construction Growth Amongst 19 European Countries As Output Declines Across The Continent – Euroconstruct

- Construction output in Ireland forecast to grow by 3.2% in 2023 and 4.4% in 2024

- Construction activity in the 19 Euroconstruct countries to contract by 1.7% in 2023 and 2.1% in 2024

- Irish new housing completions estimated at 31,000 for 2023 and 33,450 for 2024 – up 7.9%

- Number of new housing completions across the 19 countries forecast to fall to just 1.51 million units in 2025, the lowest figure since 2016.

Construction output in Ireland is forecast to grow at the strongest rate among 19 European countries, expanding by 3.2% this year and 4.4% in 2024. This comes at a time when total construction activity in Europe is expected to fall by 1.7% in 2023 and 2.1% in 2024 as macroeconomic uncertainty, interest rate increases and tightening credit conditions impact the construction sector across the continent.

That’s according to Euroconstruct, an independent construction market forecasting network active in 19 European countries, which is holding its 96th conference at EY Ireland in Dublin today. The 19 country partners of the Euroconstruct network analyse factors influencing the three principal segments of construction – residential, non-residential (e.g., office, industrial, hospitals and schools) and civil engineering (e.g., transport, energy and water infrastructure).

In Ireland, the level of new housing completions is now expected to meet or exceed national targets, with completions estimated at 31,000 in 2023 and 33,450 in 2024. Ireland is the only country forecast to see strong growth next year, up 7.9% during this period. The civil engineering sector in Ireland is forecast to grow by 2.4% in 2023 and 5.3% in 2024, while the non-residential sector will grow by 2.9% and 2.6% over the same two-year period.

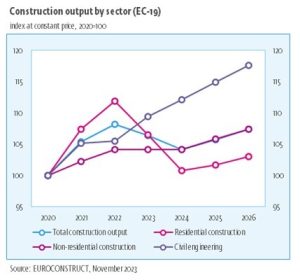

Following a period of significant construction growth as economies rebounded post-pandemic, most European markets are now forecasting a contraction in growth in 2023 and 2024. A total of 13 countries forecast a decline in the coming year in housing completions, with marginal growth expected in Switzerland, Slovakia and the UK, and modest growth in Spain and Portugal. By 2025, the number of housing completions across the 19 countries, is forecast to fall to 1.51 million units, the lowest figure since 2016 and substantially below the 2.61 million units delivered in 2007. More positively, the civil engineering sector is set to expand from 2023 to 2026 across Europe, driven by strong public investment in infrastructure as well as ongoing investment in renewable energy and telecommunications infrastructure. The non-residential market is forecast to be the weakest of the sectors across 2023 and 2024, before resuming modest growth in 2025.

Annette Hughes, Director at EY Economic Advisory and member of Euroconstruct, says:

“In what is a very challenging period for construction activity across Europe, Ireland is bucking the trend with strong growth forecast over the next number of years, particularly in the residential and civil engineering sectors. Euroconstruct is forecasting that new residential construction in Ireland will grow by 12.3% in 2023 and 2024, a period where we are forecasting a15% reduction in residential construction activity across the 19 Euroconstruct countries. Construction growth in Ireland is being driven by a number of factors, including strong demand, a suite of policy measures and incentives and a dynamic construction sector.

“From a broader construction perspective, the establishment of the Infrastructure, Climate and Nature Fund announced in Budget 2024 is particularly welcome. All too often, infrastructure expenditure is one of the first areas to be cut during an economic slowdown, so pre-empting this cycle via the establishment of a new Fund now is welcome long term, strategic decision making..

“While the forecast for Ireland is bright, there are a number of areas where focus needs to be maintained. It is welcome that construction inflation is beginning to moderate, however the sharp rise in interest rates and the cost of capital remains a significant concern. Moreover, skills shortages continue to be an issue across the construction sector. In this context, in tandem with the ongoing expansion of national apprenticeship programmes, the widescale adoption of Modern Methods of Construction will play an important role in the construction sector of the future.”

Conference Turns Focus to Modern Methods of Construction

The theme of the 96th Euroconstruct conference taking place at EY Ireland in Dublin this week is Modern Methods of Construction (MMC), digital technologies and innovation. MMC is a term used to describe a range of offsite manufacturing processes and onsite techniques that provide alternatives to traditional construction. Typical MMC systems include timber frame, steel frame, and precast concrete, which are viewed as having the potential to transform the productivity of the construction sector.

Simon MacAllister, EY Ireland Partner in Valuations, Modelling and Economics says;

“As it becomes increasingly important to deliver high-quality infrastructure and homes at pace, the way in which we deliver is a critical enabler. Adopting Modern Methods of Construction is crucial to improve productivity in construction in Ireland and across Europe. By amplifying the strength of the traditional construction industry with digitally enhanced manufacturing and the adoption of technological solutions, many of the construction challenges around speed of delivery, quality, viability and productivity can be overcome.”

| TOTAL CONSTRUCTION OUTPUT | (% change in real terms) | ||||||||

| Country/Year | Estimate | Forecasts | Outlook | ||||||

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | |||

| Austria | -3.6 | 1.8 | -1.8 | -2.7 | -4.1 | 0.4 | 1.9 | ||

| Belgium | -4.6 | 5.6 | 0.7 | -0.3 | 0.2 | 0.2 | 0.5 | ||

| Denmark | 7.3 | 6.4 | 4.1 | -6.1 | -4.9 | 3.7 | 3.9 | ||

| Finland | -1.1 | 0.1 | 1.1 | -10.1 | -1.4 | 3.4 | 2.2 | ||

| France | -12.1 | 6.6 | 2.1 | -2.2 | -0.8 | 0.8 | 1.4 | ||

| Germany | 2.3 | -0.4 | -1.7 | -2.3 | -2.2 | -0.9 | -0.6 | ||

| Ireland | -9.1 | -3.0 | 2.6 | 3.2 | 4.4 | 2.2 | 2.6 | ||

| Italy | -4.5 | 17.9 | 12.0 | -0.7 | -7.3 | 0.6 | 1.1 | ||

| Netherlands | 0.2 | 2.2 | 3.3 | 0.6 | -2.5 | 0.3 | 2.8 | ||

| Norway | -0.9 | 0.5 | -2.3 | -2.8 | -0.4 | 7.0 | 2.8 | ||

| Portugal | 3.4 | 10.8 | 0.6 | 1.3 | 1.5 | 1.5 | 1.7 | ||

| Spain | -9.4 | 6.7 | 3.3 | 2.8 | 1.4 | 1.2 | 2.0 | ||

| Sweden | 0.0 | 5.7 | 1.7 | -10.6 | -5.7 | 5.7 | 3.0 | ||

| Switzerland | -0.6 | -2.8 | -5.7 | -1.1 | 1.6 | 2.8 | 2.2 | ||

| United Kingdom | -14.2 | 11.7 | 6.1 | -1.6 | -2.1 | 4.4 | 2.5 | ||

| Western Europe (EC-15) | -4.6 | 5.5 | 2.6 | -1.7 | -2.3 | 1.4 | 1.4 | ||

| Czechia | -3.3 | 1.7 | 1.7 | -1.8 | 0.2 | 3.5 | 6.4 | ||

| Hungary | -6.6 | 4.4 | 1.3 | -8.0 | -3.8 | 4.9 | 5.4 | ||

| Poland | -0.6 | 4.7 | 8.5 | 2.2 | 2.5 | 3.4 | 3.5 | ||

| Slovakia | -12.5 | -3.3 | 0.8 | 0.1 | 2.9 | 0.7 | 3.9 | ||

| Eastern Europe (EC-4) | -3.4 | 3.2 | 4.9 | -0.6 | 1.0 | 3.5 | 4.5 | ||

| Euroconstruct Countries (EC-19) |

-4.5 | 5.3 | 2.7 | -1.7 | -2.1 | 1.5 | 1.6 | ||

| Source: EUROCONSTRUCT, November 2023 | |||||||||

More information on the results of the 96th EUROCONSTRUCT conference in Dublin and construction development in Europe by 2026 can be found in two reports from the Conference: “Summary Report” and “Country Report”. These reports can be ordered from the organiser of the conference or from your local EUROCONSTRUCT member www.euroconstruct.org).