Michel Denis, President & Chief Executive Officer, stated “Cumulative 9-month

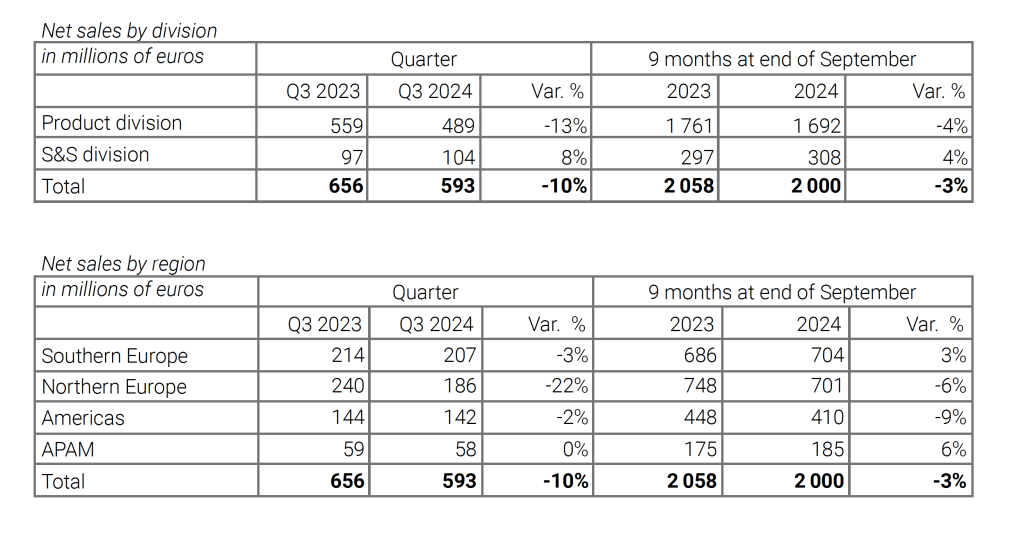

revenues reduces by 3% in comparison to 2023, September. This slowdown is due to an economical and geopolitical environment deterioration from this summer as well as a high level of dealer inventories in Northern Europe and Northern America.

An order intake on equipment rebound appears following several decreasing quarters. The order book on equipment becomes gradually normalized around 6 months of activity.

We currently do not anticipate a significant evolution of the business environment till the year end.

Thanks to the team’s efforts, the group anticipates, for the whole 2024 year, revenues slightly decreasing compared to 2023, with a recurring operating profit above 7% of the revenues.”

Review by division

With quarterly revenues of €489 million, the Product division recorded a decrease of -13% compared with Q3 2023, and -4% over the first 9 months of the year. The division dynamically adjusts its organization to the current context while keeping its in-depth work to support the long term group growth (inauguration of the Yankton plant extension in the United States, the building launching of the new mechanical welding site in France dedicated to the aerial work platform).

With quarterly revenues of €104 million, the Services & Solutions division (S&S) recorded a +8% increase in revenues compared with Q3 2023, and a +4% increase over the first 9 months of the year, illustrating the best resilience of its activities.

The division has strengthened its Southern Africa presence with the acquisition of Dezzo dealer activities.