The Board of Directors of Manitou BF, chaired by Jacqueline Himsworth, today approved the Group’s consolidated financial statements for the first half of 2024.

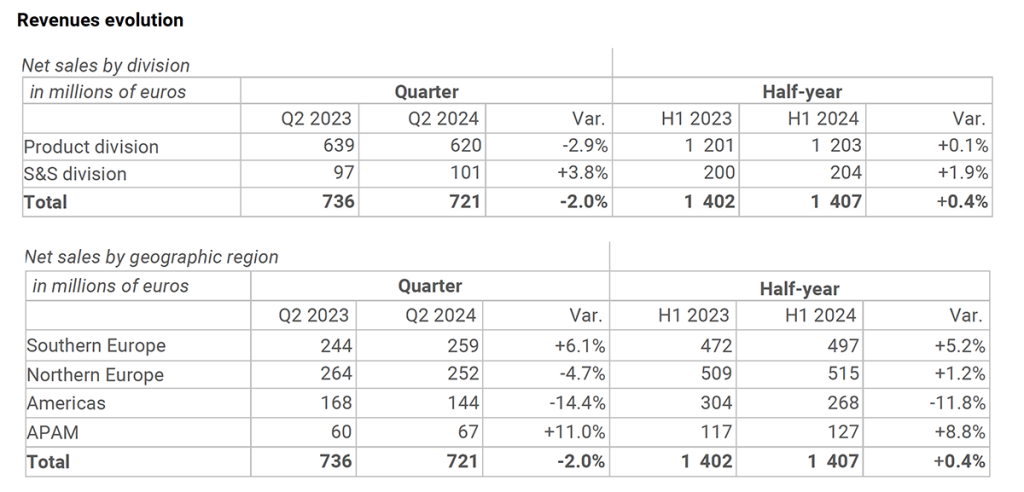

Michel Denis, President & CEO, stated: “The group closes a very good half-year in a context of contrasting activity and outlook. Sales for the first half were stable compared with the first half of 2023. Driven by stronger than expected momentum in Southern Europe, growth in Europe offset the decline in North America. Our ambitions for further growth in North America have been compromised by a lack of operational fluidity and by a much slower than expected ramp-up of our US industrial capacities, both of which we are gradually rectifying.

Our first-half financial performance continues to benefit from the improvements we have been making over the past 18 months.The delayed effect of the realignment of sales prices with raw material prices achieved throughout the previous year is now bearing full fruit. This has been combined with a more favorable customer and product mix as well as reasonable control of fixed costs. All these factors helped to raise recurring operating profit for the half-year to 9.1% of net sales, the highest level for the last 15 years.

However, this excellent performance will not be repeated in the second half of the year. In fact, the order intake dynamic remains an important area of concern, and it is too early to know its medium-term direction. In addition, the disparity in the depth of the order book between product lines has led us to reduce production at most of our industrial sites.

All these factors allow us to confirm our sales and recurring operating profit guidance for 2024.”

Review by division

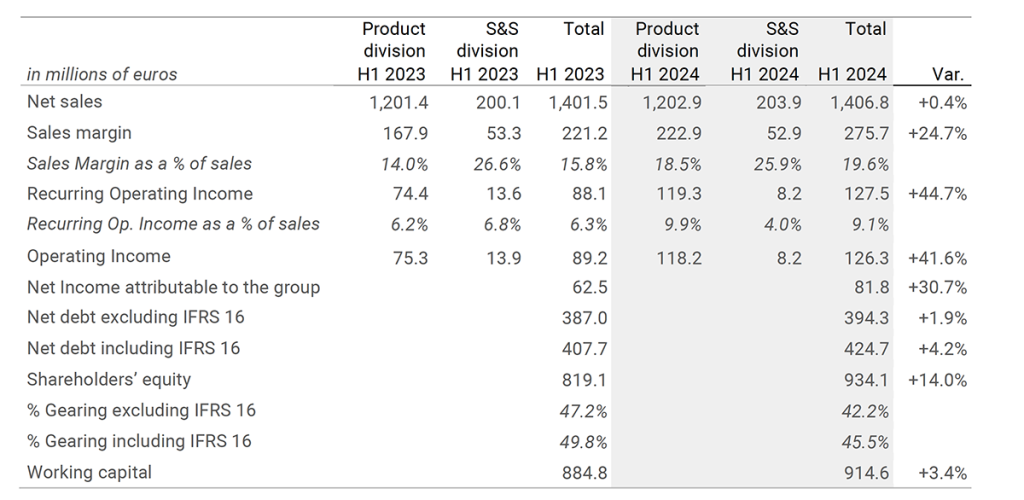

The Product division reported revenues of €1,203 million, stable over six months compared with 2023 (steady at constant scope and exchange rates). It continues to benefit from the policy of increasing selling prices that has been in place since 2022 to counter inflation on raw materials, and is also benefiting from an improvement in production efficiency linked to the reduction of tensions on our supply chain. Since January 2024, the division has also included the mechanical welding activities from the acquisition of 2 Italian companies, which contributed €7 million.

The division’s margin on cost of sales reached €222.9 million, up 33% compared with the first half of 2023, thanks to a sharp improvement of 4.5 points in the margin on cost of sales. The margin recovery is attributable to the pricing policy implemented to offset the increase in raw material prices, and to the improvement in industrial efficiency thanks to the investment programs.

Recurring operating profit of the Product division rose sharply by €44.9 million to €119.3 million (9.9% of sales), compared with €74.4 million in the first half of 2023 (6.2% of sales).

With revenues of €204 million, the Services & Solutions division (S&S) recorded growth of +1,9% over 6 months (also +1,9% at constant scope and exchange rates). Over the first half, the division was driven by the dynamism of its machine rental business (+11%) and by the strengthening of its service offer (+15%), particularly in digital services and machine maintenance.

The margin on cost of sales fell by €0.4 million (-0.8%) compared with the first half of 2023, reaching €52.9 million. This decline was due to a 0.7 point deterioration in the margin rate on cost of sales, impacted by pressure on the selling prices of parts and an increase in depreciation expenses as a result of higher depreciation of the rental fleet.

Thus, the division’s profitability came to €8.2 million (4.0% of sales), down by €5.7 million compared with the first half of 2023 (€13.9 million, or 6.9% of sales).