Chris Osborne, Sales Manager for Euro Auctions, looks back and reviews 2023.

With 2022 characterised by low supply and high prices, 2023 evolved into a very different year. The striking difference being the increased volumes of equipment for sale, never seen before at this level in the UK, with prices correcting and stabilising in the last 12 months after the COVID price bubble.

2023 – Key Trends

Throughout 2023 we saw OEM’s catch up with the backlog of new equipment orders placed over the previous 12-18 months, however the world had changed. With the global economy in a fragile position, with the cost of finance increasing and with reduced demand from major construction contracts, we have seen customers backing off from the delivery of new machines. Customers who had committed to purchase significant quantities of new machines were reducing exposure and taking fewer units. This resulted in increased availability of new equipment, across almost all brands and machine types, and with this increased availability, manufacturers and dealers were coming to the table with keener pricing and proposals to keep the new stock moving. This in turn resulted in a softening of used equipment pricing.

It’s been noted that many main dealers with a large quantity of used equipment stock, purchased throughout the booming times of 2022 and into early 2023, no longer have an appetite to buy in used stock and are now offering much less attractive ‘trade in’ values. And this is where Euro Auctions has been consistent, offering an attractive and efficient outlet for customers looking to dispose of their used units when taking in new machines. No matter what the market sentiment, Euro Auctions can always be relied upon to provide vendors with worldwide exposure to serious buyers for their machines.

Whilst the market has softened, or normalised, back to where it would have been, pre Covid, Euro Auctions presents good disposal opportunities for customers making way for new stock. We consistently achieve prices set by market demand, we market and sell globally, gaining a much wider audience than purely local buyers, and we can find buyers for vendors of specialised machines and equipment. Euro Auctions would not be selling the repeated volume of lots we do, at every sale at our flagship site in Leeds, if we were not meeting our consignors’ expectations, gaining the very best price, at that moment in time.

Every 6 weeks, the Leeds sale puts more than 6,000 pieces of new and used machinery across the ramp at each auction, totalling £45m to £60m in sales. This proves that consignors are confident they’re getting their equipment on the right stage, in front of our global audience, and sure they are getting the most back, which is a true market price.

At the last Euro Auctions sale of the year, in December 2023, the hammer for the sale was close to £43 million, representing an increase of 18% over this time in 2022. And with 8+ sales in 2023 this popular auction grossed close to £400m in sales for the year. In the last 12-months Euro Auctions has sold more machines than any other auction house in Europe. In March 2023 Euro Auctions reported selling 1,000 Excavators in a single Leeds sale for the first time and went on to do this consecutively at the three following auctions. Now, Euro Auctions consistently sell in excess of 1,500 diggers, from minis, up to 20t and above, at each and every Leeds sale.

Global Sales Teams

In 2023 we expanded our sales teams in the UK, Europe, Middle East, and Australia, as well as the teams in Yoder & Frey in USA and Michener Allen in Canada, giving the Euro Auctions group a greater global reach. This ensures that we can market globally, attract the biggest buying audience, providing more coverage, and strategically, we are attracting industry specialists to the team. Whilst all our sale team are universally conversant with the used machinery market, we are attracting specialists in haulage, in commercial vehicles, in cranes and lifting, in agricultural, and compact equipment.

What are the other 2023 UK Trends?

In 2022 most equipment and machinery bought at a Euro Auctions sale, in the UK, was staying in the UK, whereas in 2023, most equipment bought at a Euro Auctions sale was leaving the UK. There was no single destination of note, no single large infrastructure project, however Europe as a region is where the majority of the equipment goes, with almost every European country buying. Other regions around the world increased or decreased throughout the year depending on their specific demand and specifically if exchange rates allowed for competitive buying.

In 2023, more OEM’s and main dealers were disposing of surplus equipment at auction, as part of their used equipment strategy, having confidence in Euro Auctions to achieve a good market price and manage their stock levels. Euro Auctions has worked closely, in some way, with almost all main plant and equipment dealers this year to assist with their used stock rationalisation.

Euro Auctions hosted eight record breaking sales at Leeds in 2023, and the ability to continually fill the Leeds yard with 6,000 + lots for sale, showing how we are able to find good machines, bringing that stock to auction, attracting serious buyers, and in turn, attracting good consignors, thus completing the circle. With total sales form Leeds approaching £400 million in 2023, this represents a 21% increase over 2022.

Collective Yearly Hammer Totals & Growth

Year Hammer Growth # Lots Online

2019 £274,151,970 + 14% 35,787 46%

2022 £294,244,909 + 7 % 40,171 75%

2021 £264,458,809 – 10% 36,286 72%

2022 £329,115,247 + 24% 40,772 67%

2023 £399,698,652 + 21% 50,490 66%

Categories Over the Ramp

To gain an overview of the most popular equipment brands of 2022, these are the numbers of makes going over the ramp at Euro Auctions, 2022 in the following categories:

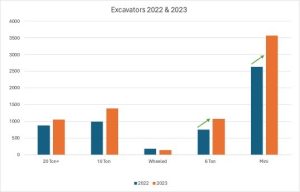

- Excavators

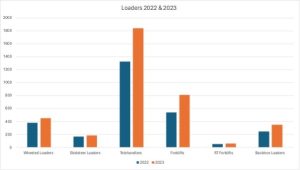

- Loaders

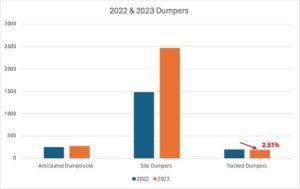

- Dumpers

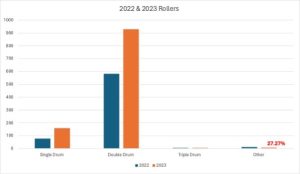

- Rollers

2022 2023 % increase / decrease

20 Ton+ 878 1058 20.50%

10 Ton 999 1386 38.74%

Wheeled 178 139 21.91%

6 Ton 758 1077 42.08%

Mini 2635 3569 35.45%

2022 2023 % increase / decrease

Wheeled Loaders 380 451 18.68%

Skidsteer Loaders 169 186 10.06%

Telehandlers 1328 1843 38.78%

Forklifts 539 811 50.46%

RT Forklifts 52 59 13.46%

Backhoe Loaders 246 348 41.46%

2022 2023 % increase / decrease

Articulated Dumptrucks 249 276 10.84%

Site Dumpers 1481 2463 66.30%

Tracked Dumpers 199 194 2.51%

2022 2023 % increase / decrease

Single Drum 79 159 101.27%

Double Drum 581 929 59.90%

Triple Drum 4 5 25%

Other 11 8 27.27%

Full details for consignors and bidder catalogues for all sales are available from Euro Auctions W: www.euroauctions.com

T: +44 (0) 2882 898262