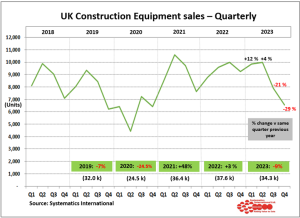

Retail sales of construction and earthmoving equipment showed further reductions in December, resulting in Q4 sales ending up at 29% below Q4 2022 levels. This was the lowest quarterly level of sales since Covid at c. 6,500 units. For the full year, sales in 2023 reached 34,300 units and were 8.8% below 2022 levels. This was 2,000 to 3,000 units below the level of equipment sales seen in 2021 and 2022, but these were the highest years since the financial crash in 2008.

As highlighted in previous reports, sales in the two halves of the year were very different in 2023. In the first half of the year, sales were 8% above 2022 levels, but in the second half they ended up 25% below the previous year’s levels. Sales in the early months of 2023 were still benefitting from the “catch-up” impact of supply chain constraints in 2022, which extended lead times for the delivery of machines. In contrast, equipment sales in the second half of 2023 experienced the impact of declining levels of construction activity, particularly in the housebuilding market.

The pattern of sales for the major equipment types is shown in the second chart below which compares sales in 2023 with the previous year. This shows percentage changes in sales for the different machine types. Wheeled Loaders (+10%) ended up as the strongest-selling product last year. Following strong sales in Q4, Telehandlers (for construction) saw the second-highest growth levels and ended up at 4% above 2022 levels. The fall in equipment sales overall in 2023 was very much driven by declining sales of excavators, with Mini/Midi excavator sales 10% below 2022 levels and Crawler Excavators 18% below the previous year.

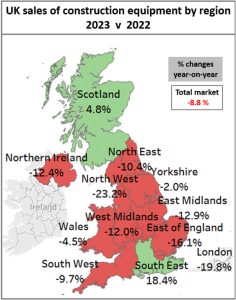

The pattern of sales on a regional basis in the UK and N Ireland is shown on the map below for 2023 compared with 2022. Similar to earlier updates, only two regions saw sales ahead of 2022 levels last year. This was in the South East of England (+18%) and Scotland (+5%). Amongst the other regions, the areas recording the biggest falls compared with 2022 were the North West of England (-23%) and London (-20%).

Equipment sales in the Republic of Ireland are also reported in the statistics exchange. Sales in Q4 continued on a declining trend and were 13% below 2022 levels. However, sales for the full year still ended up at 1% above 2022 levels. As reported previously, this was due to a very strong start to the year, where sales were 24% above 2022 levels in Q1.

The construction equipment statistics exchange is run by Systematics International Ltd. This scheme is run in partnership with the Construction Equipment Association (CEA), the UK trade association.